News Room

FEATURED NEWS

All News & Publications

Filter

Resource type

Date

Focus

Activity Type

announcementCatch the Wave of Global Water Decarbonisation

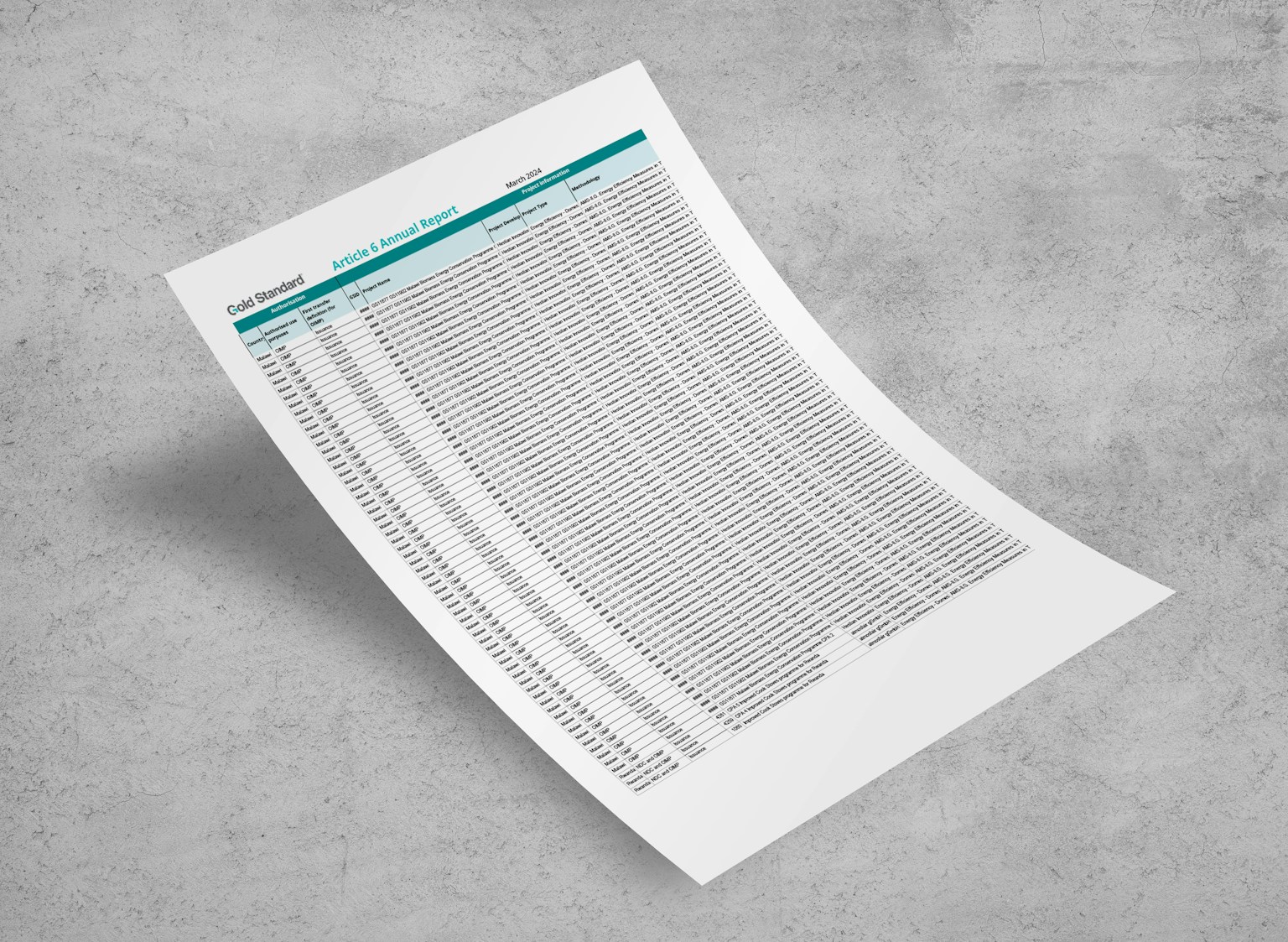

announcementCatch the Wave of Global Water Decarbonisation reportArticle 6 Annual Report

reportArticle 6 Annual Report

consultationMethodology for Sustainable Management of Mangroves

consultationMethodology for Sustainable Management of Mangroves

announcementGold Standard’s Pilot Adaptation Framework Updated

announcementGold Standard’s Pilot Adaptation Framework Updated