Carbon Pricing series - Investing in climate and development projects is a powerful way to contribute to the transition to a low-carbon, climate secure world.

However, it can seem complex – especially answering what appears to be a simple question of how much you should pay for a carbon credit. While your carbon provider can guide you through the process, this series of articles aims to provide some clarity in how carbon credits are valued, taking into account the differences among the projects that issue them.

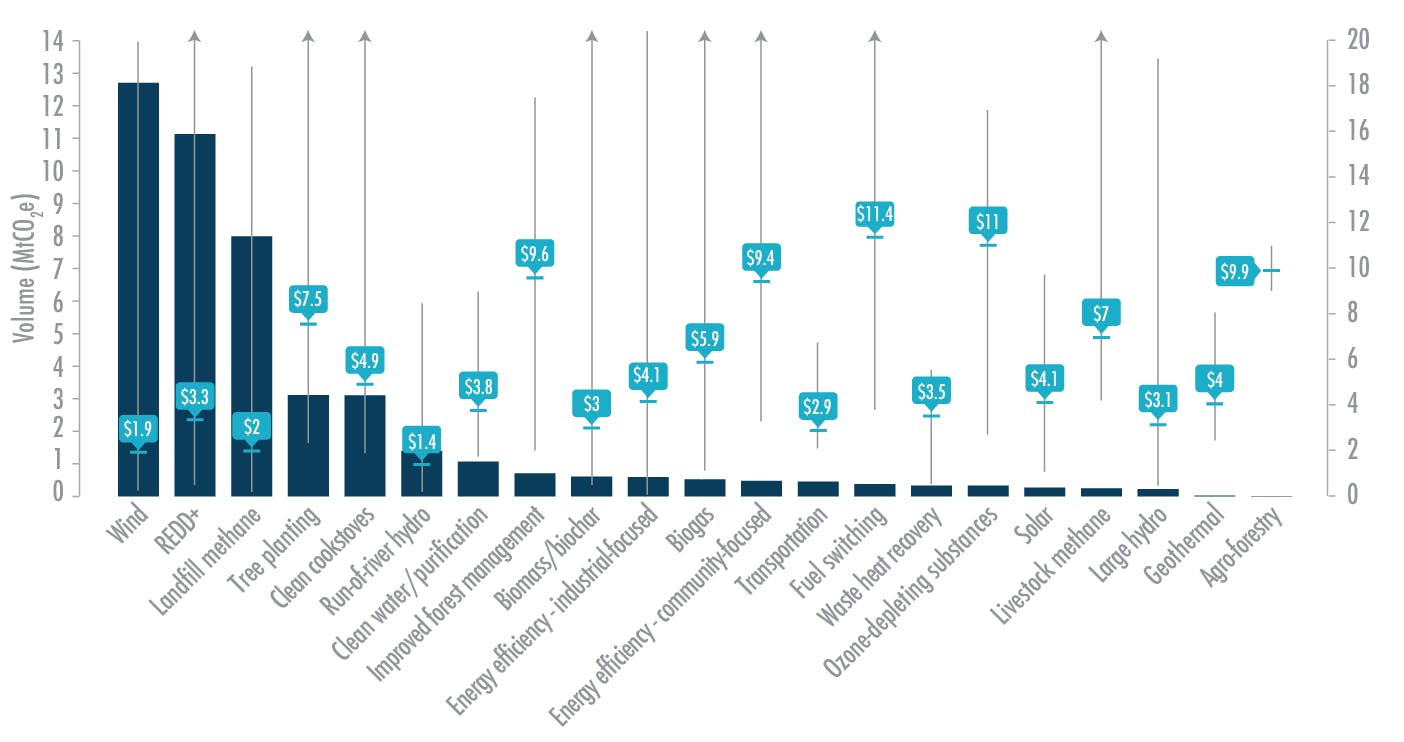

In the Q1 2016 edition of our Supply Report we discussed the different ways to value a carbon credit, whether by using market dynamics as a guide, pricing a project based on its cost or based on the value that a project delivers. However, pricing also varies based on the project type and can even vary within the same type of projects (see figure 1). This article highlights some of the reasons for this difference, outlining the key factors that should be considered when purchasing carbon credits.

Fig. 1 Transacted volume, average price and price range by project type, 2015

Value of beyond-carbon benefits

While all Gold Standard projects must deliver impacts in sustainable development beyond climate security, different project types provide different levels of benefits. For example, a large-scale wind project based in Turkey provides more country level benefits such as better access to clean technologies, local employment opportunities, more energy independence and increased social stability. Whereas an improved cookstove project based in Rwanda benefits people at a community level. It decreases indoor air pollution, improving health predominantly among women and children. Less wood is required helping to decrease deforestation and saving families money, and less time is needed for collecting wood providing more opportunities for schooling and social activities.

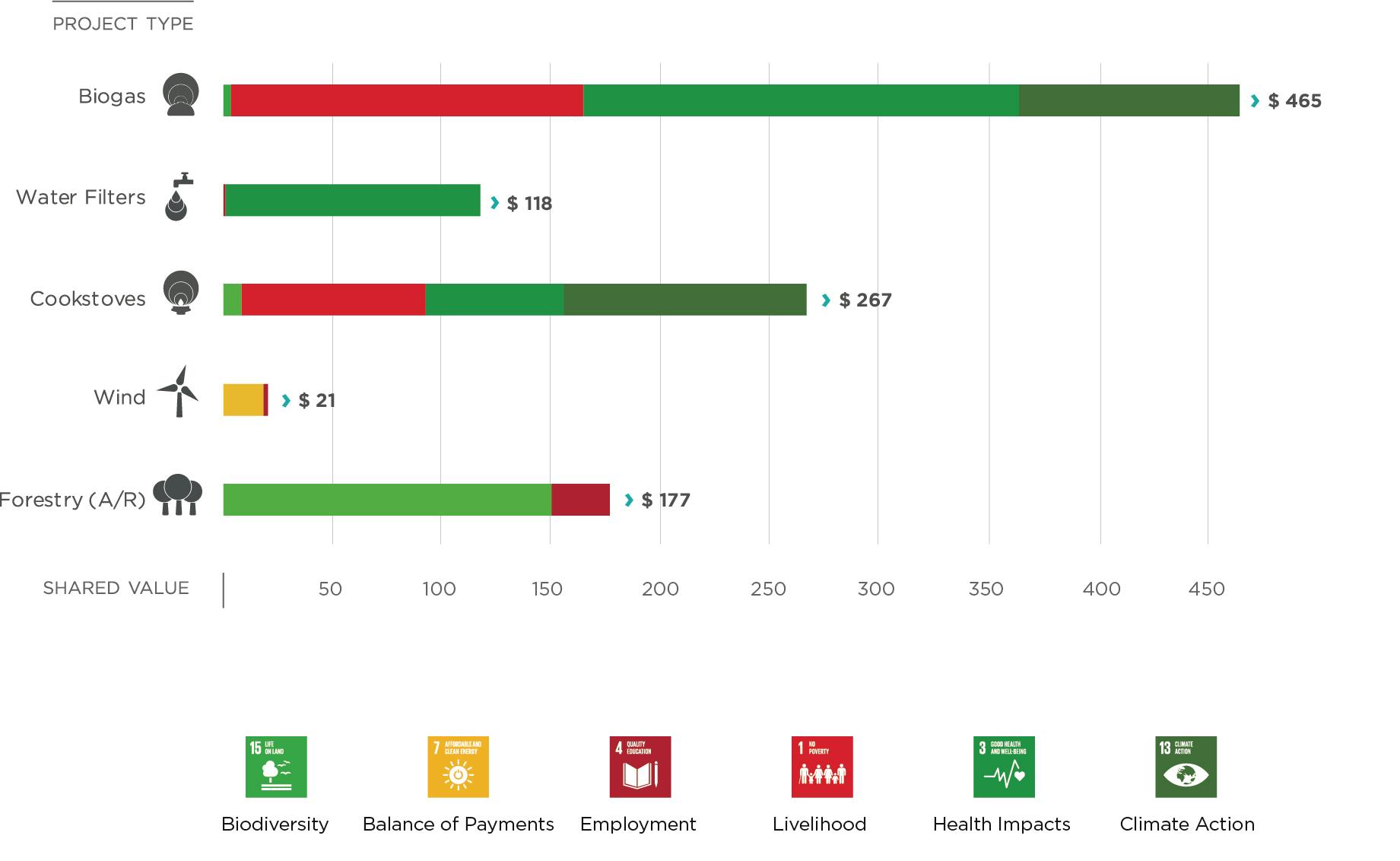

Although the sustainable development benefits delivered by wind projects are also important, often carbon credits from cookstove projects will sell at a higher price. This is due to the value over and beyond carbon that a project delivers, the tangibility of these benefits and that many investors feel they can make more of a direct impact at a community level. For example, if you look at the outcomes from the impact report we commissioned (see figure 2), you can see that although wind projects provide more value in the balance of payments – i.e. the value created from reducing the amount of fossil fuel imports - the additional value it provides is just $21 per tonne of CO2 reduced. Compare this to cookstove projects that deliver $151 in additional benefits and you can see that by investing in the same product (i.e. a carbon credit), you can make more of a direct impact on the lives and health of vulnerable communities. This greater value normally correlates to a higher cost per credit.

Fig. 2 Monetary value of Gold Standard project impacts per ton of reduced CO2 emissions (Figure updated Dec 2019)

Size and location of the project

The size of the project can be important when considering the cost of the credit issued. In many cases it’s the small-scale projects that contribute the greatest positive impacts, however, these smaller projects are often more expensive to implement and produce fewer carbon credits, making it harder to reimburse the implementation costs unless the credits are sold for higher prices.

Project location can also be a deciding factor that affects price. For some countries it is difficult to implement emission reduction projects due to a lack of infrastructure, resources, or because they are considered high risk, such as those regions that suffer from conflict. However, it is often these regions that benefit the most from the implementation of climate and development projects. Tools and mechanisms have been developed to help increase the number of projects in such regions, however, to make these worthwhile within a carbon market, credits would need to be sold at a higher price.

Also, prices can vary due to the availability of credits from a particular country, for instance according to the latest State of the Voluntary Carbon Market Report published by Ecosystem Marketplace, carbon credits from wind projects based in India (which are in abundance) sold at an average of $1.2/tonne compared to those originating from the US, which typically sold for $3.7/tonne.

And finally, the price a buyer is willing to pay can depend on their organisation’s objectives and key priority areas. For example, some companies may pay more for a project that is closely linked to their supply chain or based in a priority region for their Corporate Social Responsibility (CSR) commitments.

Project vintage

Another market trend that affects pricing is the age of the carbon credits; that is, when the emission reduction took place. Gold Standard maintains that – as long as it meets the criteria of a reputable standard - it shouldn´t matter whether the emission reduction happened this year or five years ago. In some ways, because of the urgency of decarbonisation and the long-lasting impacts of carbon emissions in the atmosphere, one could argue that an emission avoided or reduced five years ago was even more valuable. Avoiding old vintages may inadvertantly punish project developers who took the risks to move forward with projects earlier.

Differences in emission reduction methodologies

Prices can vary within the same project type and this can often be related to the methodology used for the project. For example, referring again to Ecosystem Marketplace´s State of the Voluntary Carbon Market Report, offsets from avoided “unplanned” deforestation projects (where the drivers of deforestation are typically smallholder agriculture or illegal logging) earned higher prices ($5.4/tonne, on average) compared to avoided “planned” deforestation projects ($1.9/tonne, on average), where the driver of deforestation (typically a large landowner or company) has a legal clearing plan that is then voluntarily altered.

Quality of the project

Like with any purchase, a key factor that influences the price is the quality of the project. In carbon markets, a project’s quality can be assessed through the standard by which it is certified. Gold Standard works to ensure that every dollar invested into a project delivers the maximum amount of benefits from both a climate and development perspective. We do this by insisting that projects take a participatory approach to design through local stakeholder engagement -- empowering them to maintain and extend the project for greater impact. Projects must adhere to environmental and social safeguards. Governance is transparent. And outcomes are long-term, consistent and comparable, providing assurance that everything claimed is real and quantifiable. It´s because of this approach that we are supported by a Technical Advisory Committee of leading experts and endorsed by a network of 80+ NGO Supporters, ensuring that projects certified to Gold Standard are of the highest quality -- reducing risk for anyone wishing to purchase carbon credits. However, like anything of quality, this rigour comes at a price, which is why Gold Standard carbon credits are often sold at a premium compared to other credits in the market.

Fig. 3 How rigour in project design leads to greater impact

Economies of scale and good communications

There are other factors that are not directly related to the project itself, but can affect the price paid for carbon credits. One such example is the number of credits purchased. Larger organisations that have a significant footprint can sometimes benefit from economies of scale when purchasing large quantities of carbon credits in one-go, as project developers or retailers are able to sell at a discounted price, due to the certainty that such a purchase provides to the project.

And finally, buyers are often willing to pay more for a project if additional services are provided, such as access to communication assets (e.g. clear project details and professional project photography) or strategies that help an organisation to successfully communicate the impact they´ve made to their stakeholders and clients.

Valuing a project is always somewhat subjective, based on an organisations ideals, objectives and requirements. Much like the real estate market, being aware of the value a project delivers, its size, location, age and quality will help organisations to find the right projects to meet their objectives both in price and impact.

Transparency in pricing

Currently, disclosure of the price you pay for carbon credits is optional. As a result, historical data for prices of credits in the voluntary carbon market has relied primarily on Ecosystem Marketplace’s annual State of the Voluntary Carbon Market. We believe that more transparency in this market and greater access to data will build confidence and enable more money to flow to those projects and people that need it the most.

Learn more about our Climate Finance Transparency Initiative