A new era of climate action is being shaped by the global coverage of the Paris Agreement, carbon market growth, innovation and diversification, and welcome increases in climate commitments by companies and investors. This prompts an evolution in claims. The goal is to continue to incentivise and recognise ambitious actors and to ensure claims are clear, credible and durable.

Fortunately, consensus is taking shape about this new claims era, with the recent publication of the Voluntary Carbon Market Integrity initiative’s Claims Code of Practice, WRI’s Guidance on Voluntary Use of Nature-based Solution Carbon Credits Through 2040 and the Nordic Code of Best Practice for Voluntary Compensation of GHG Emissions.

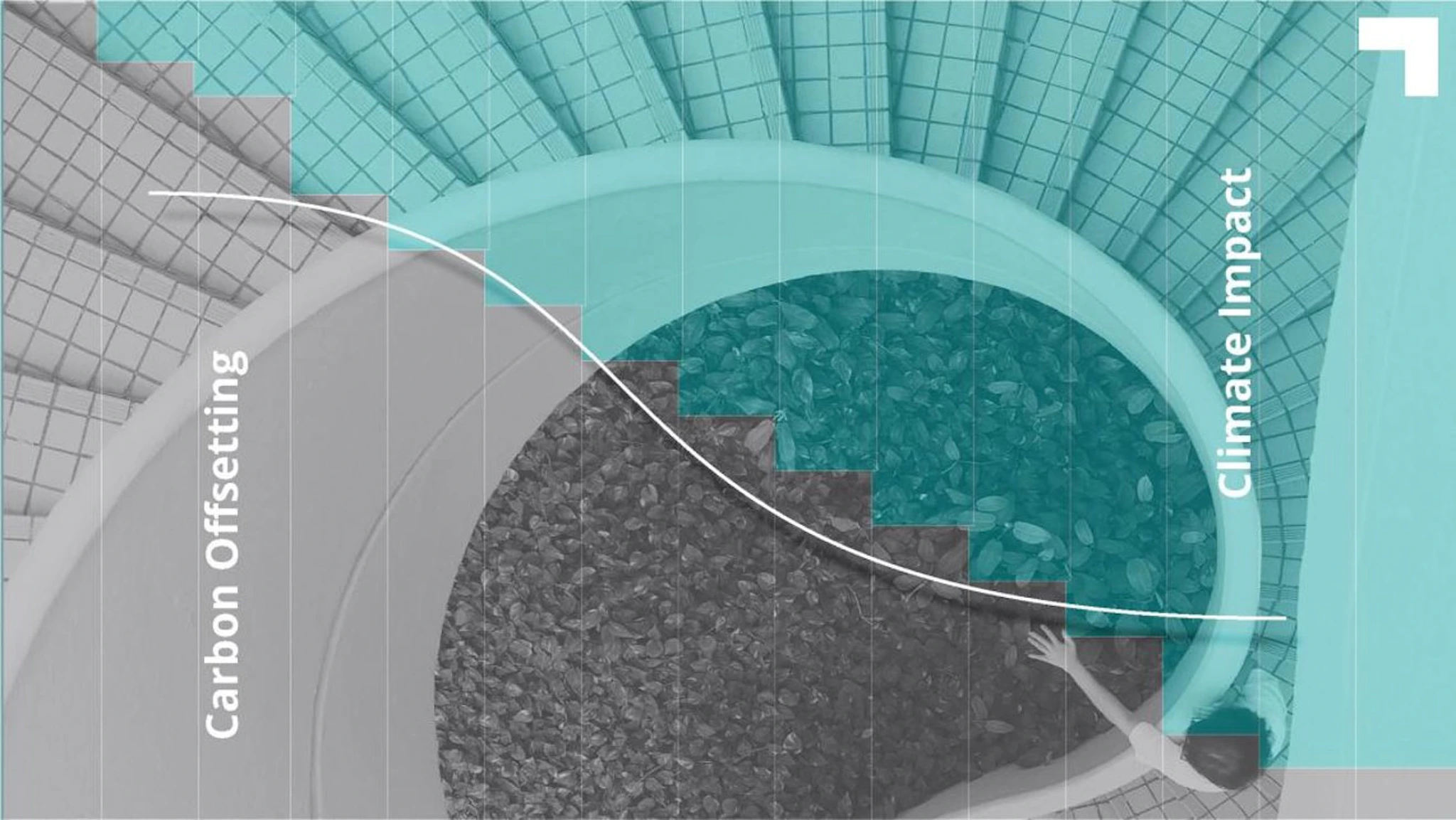

Very much in the same spirit of these initiatives, Gold Standard has published updated Claims Guidelines, where we outline new best practices for the use of post-2020 carbon credits. The short story is that we see a future where companies increasingly shift from 'carbon offsetting' and 'carbon neutral' claims toward new ways of describing the use of carbon credits and the climate impact they deliver.

New claims in practice

Some companies are already taking this approach. For example, on Earth Day 2022, PayPal shared how they continue to "invest in the future of possibility as environmental sustainability and climate action are critical to PayPal’s mission of enabling all people to participate fully in the global economy” and highlighted multiple ways of doing so, including through the purchase of Gold Standard-certified carbon credits. See PayPal's Earth Day announcement here.

Advantages of the new claims era

While the commitment to take full responsibility for unabated emissions remains one part of a best practice corporate climate strategy, moving beyond 'carbon offsetting' or 'carbon neutral' helps mitigate several potential risks that come into play with that inherent promise that the atmosphere is no worse off despite a company’s emissions. These include:

- The possibility of ambition being displaced in project host countries when credits do not have corresponding adjustments

- The potential for reversal of carbon sequestration, when the vast majority of today’s approaches cannot promise carbon storage for the same duration of GHG emissions in the atmosphere

- Consumers’ mistakenly interpreting a ‘carbon offset’ or ‘carbon neutral’ to mean that a company hasn’t had any climate impact at all

A period of transition

In recent years, ‘carbon offsetting’ has rightly been identified as one tool to drive the global transition to a low-carbon sustainable future. ‘Carbon neutrality’ has increasingly been recognized as a way of defining ambition for addressing unabated emissions, though new approaches linked to the social cost of carbon are also emerging. Fortunately, demand for carbon credits has finally increased to support more sustainable pricing for project developers delivering real climate and development impact on the ground.

Therefore, a transition is in order to support those organisations that have truly sought to do the right thing by purchasing carbon credits from climate protection projects as part of their science-based climate strategy.

Gold Standard commits to continue collaborating with market participants and civil society to support the emergence of ‘non-offsetting’ claims and further best practices for various ways of financing beyond-value chain climate action.